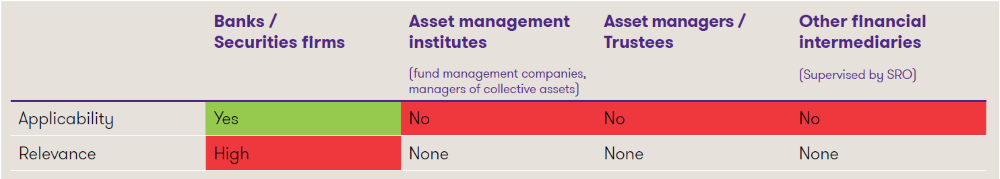

Classification of the innovations1

1This is a highly simplified presentation, which should enable a quick initial classification of the topic. Each institution should determine the relevance and the concrete need for action individually.

If the renewal is made in good time via the electronic Qualified Intermediary Application and Account Management System (QAAMS), the new QI Agreement will enter into force retroactively as of 1 January 2023. Institutions that fail to make the transition by 1 May 2023 will lose their status as Qualified Intermediary retroactively as of 31 December 2022.

Overview

The new QI Agreement does not contain any fundamental innovations. Nevertheless, there are some relevant points that need to be considered. The following selected topics are explained below:

- Coverage of “Publicy Traded Partnerships” (PTPs)

- Submission of Periodic Review Reports to the IRS

- New Appendix III

In addition, the IRS has clarified various points in its QI FAQs, which are available online, in order to take into account the practice of recent years.

Coverage of Publicly Traded Partnerships (PTP)

From 2023 onwards, there will be an obligation in certain cases to withhold tax on distributions from publicly traded partnerships (PTPs) operating in the USA and on proceeds from the sale of their units. Since the holding or sale of such PTP units may give rise to a tax liability in the USA, Qualified Intermediaries must also obtain the available American tax numbers (U.S. TINs) from all clients concerned, regardless of their domicile.

Currently, the challenge for Qualified Intermediaries is the identification of clients affected by the regulation on PTPs. Specifically, data sets supplied by different professional providers define the group of affected PTPs inconsistently. As far as the required withholding tax deductions are concerned, it can be assumed that these will be made and documented with Form 1042-S by the upstream primary withholding agents – similar as in the case of the 871(m) regulation introduced a few years ago. This goes hand in hand with the fact that the introduction of the provisions on PTPs is associated with disproportionately higher requirements for institutions acting as primary withholding agents than for other Qualified Intermediaries.

Submission of Periodic Review Reports to the IRS

The provisions on triennial QI periodic reviews and the possibility of being exempted from the corresponding requirement under certain conditions (“waiver”) remain largely the same. What is new is that periodic review reports must now always be submitted to the IRS together with the triennial certification by the QI Responsible Officer, no longer only at the express request of the IRS.

New Appendix III

In a new Appendix III to the QI Agreement, the IRS defines rules for reconciling the information on Forms 1042-S received from primary withholding agents with that on Forms 1042 and 1042-S prepared by the Qualified Intermediary itself. In particular, it specifies – as a welcome aid – the extent to which the totals of certain lines of the corresponding forms must match.

Assessment and outlook

As mentioned at the beginning, the new QI Agreement does not entail any fundamental changes. It is essential that Qualified Intermediaries transfer their existing QI Agreement to the new QI Agreement on the electronic IRS portal by 1 May 2023 and meet this deadline. In addition, it is recommended that Qualified Intermediaries clarify in a timely manner with their upstream primary withholding agents how the implementation of the new requirements on publicly traded partnerships (PTPs) are to be implemented in concrete terms.