-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

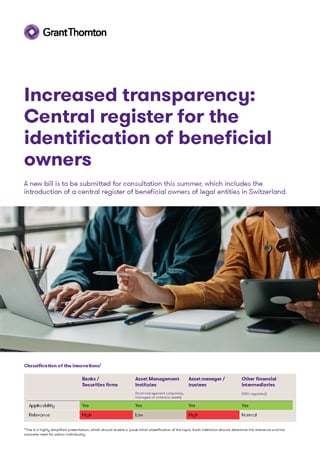

Classification of the innovations1

1This is a highly simplified presentation, which should enable a quick initial classification of the topic. Each institution should determine the relevance and the concrete need for action individually.

Current status in Switzerland

In October 2022, the Federal Council instructed the Federal Department of Finance (FDF) to draft a bill by the end of June 2023 to increase transparency and facilitate the identification of beneficial owners of legal entities. The bill is intended to introduce a central register for identifying beneficial owners (BO register) and updating their information. The register is to be accessible to certain authorities, but not for the public.

International Standard

Corporate vehicles can, for example, be misused for illegal purposes such as money laundering with shell companies and complex ownership and control structures. The Financial Action Task Force (FATF) addresses these risks with increased transparency of legal entities. The revised FATF recommendation of March 2022 on the transparency of legal entities and the identification of beneficial owners recommends that legal entities obtain up-to-date information on beneficial ownership and have it kept in a register by an authority. The FATF also explicitly left room for an alternative mechanism (no register, but access by authorities to information held by financial intermediaries). In March of this year, the FATF published guidance to assist member states in designing appropriate measures.

The EU/EEA member states have already introduced a BO register at national level in 2017. Their implementations serve as a point of reference for Switzerland to design its own transparency register and define obligations for companies and financial intermediaries.

BO registers in EU/EEA Member States

-

Obligated parties

All domestic legal entities, partnerships and asset units are obliged to obtain the necessary BO information and to transmit it to the register-keeping authority. Foreign trusts administered in Switzerland or trusts administered in a third country that have entered into a business relationship with a financial intermediary or acquired real estate in Switzerland are also obliged to do so (unless they provide proof that the beneficial owners are entered in a register of another EU or EEA member state). For their part, the beneficial owners are obliged to provide the respective company with the necessary information.

-

BO information

The following BO information shall be provided to the registering authority: Surname, first name, date of birth, country of residence and nationality. In addition, information on the economic interest of the beneficial owners must be provided. The notification must be made within 30 days of the relevant event (e.g. entry in the commercial register or incorporation) or of becoming aware of changes.

Within the framework of the new EU anti-money laundering directive, an expansion of the information to include place of birth, residential address, national identification number as well as tax identification is being discussed (whereby certain information may not be disclosed to third parties). In addition, the date of acquisition of ownership rights and a description of the control and ownership structure are to be included. If no person exercises control over a legal entity, a substantiated declaration that there is no beneficial owner or that the beneficial owner could not be identified is to be included.

-

Access to the BO register

The BO registers in the EU member states must be publicly accessible since 2020 due to the requirements of the 5th EU Anti-Money Laundering Directive. Thus, according to the German Money Laundering Act, in addition to authorities, courts, etc., as well as obligated parties, in principle all members of the public can also inspect the transparencyregister after prior online registration. The inspection for anyone includes the first and last name, month and year of birth, country of residence, nationality and the type and scope of the beneficial interest. A beneficial owner may, upon application, obtain a complete or partial restriction of access vis-à-vis the public, provided that he or she can claim an overriding interest worthy of protection. This includes, in particular, being exposed to the risk of becoming a victim of a criminal offence (fraud, extortion, etc.).

However, the opening of the transparency register to the public is not uncritical from a fundamental rights and data protection perspective. There is a risk of misuse and, depending on the design of access to personal data, it is questionable whether such an encroachment on fundamental rights is proportionate. Since a ruling by the European Court of Justice (ECJ) on 22 November 2022, members of the public in Germany are only permitted to inspect data if they justify the request for inspection and demonstrate a legitimate interest in doing so; the 5th EU Anti-Money Laundering Directive was declared null and void on this point.

In Liechtenstein, data is disclosed to third parties exclusively for the purpose of performing due diligence (persons subject to due diligence) or acts to combat money laundering, predicate offences to money laundering and terrorist financing. The registry authority refuses disclosure if, among other things, the declaration made is not credible. Liechtenstein also has the possibility of having the disclosure of data fully or partially restricted if there are interests worthy of protection.

-

Obligations for financial intermediaries

The Due Diligence Act in Liechtenstein or the Money Laundering Act in Germany stipulate that financial intermediaries must obtain a corresponding extract from the register when entering into a business relationship with companies. If they discover discrepancies between the BO information they have collected themselves and the data contained in the register extract, this generally triggers a reporting obligation to the authority keeping the register. If the company concerned initiates a correction upon notification by the financial intermediary or if the financial intermediary makes an FIU report, this reporting obligation may be waived.

Future BO register in Switzerland

In Switzerland, Swiss legal entities and certain foreign legal entities with a Swiss connection are to be obliged (in accordance with a risk-based approach) to collect and transmit BO data. The BO information (including surname, first name, date of birth, nationality, address of residence) must be accurate and up-to-date, which requires verification. Consequently, procedures for clarification, the responsibility of the board of directors and sanctions for incorrect entries etc. must be provided for. According to the Federal Council, the register in Switzerland should not be public, but only accessible to relevant authorities. Similar to Germany and Liechtenstein, it can be assumed that in future Swiss financial intermediaries will also have to obtain an extract from the BO register when entering into a business relationship and check it for discrepancies. Possible further obligations for financial intermediaries are currently still unclear. The introduction of the BO register is planned for 2026.

Conclusion

With the introduction of the BO register, Switzerland will take a step towards increased transparency. When exactly and in what form the BO register will be introduced in Switzerland remains to be seen. A look abroad shows what implementation in Switzerland could look like, what obligations companies, boards of directors and financial intermediaries could face and what the challenges are.

Should the obligations for financial intermediaries derived from this be introduced in a similar way as in Germany, for example (including the obligation to obtain and verify an extract from the register and new reporting obligations), this is likely to result in a certain amount of additional work, particularly for banks, asset managers and trustees.